Tauler&Fau Subastas - Auction 151 Tauler&Fau Selection . Lote 28 Numistats ref: 670629

Nero

Authority

Sestertius

Denomination

-

Year

RIC ric.1(2).ner.356

RIC 356

References

Imperio Romano

Category

Nerón. Sestercio. 67 d.C. Roma. (Ric-I 356). (Bmcre-114). (C-284). Anv.: IMP NERO CLAVD CAESAR AVG GERM P M TR P XIII P P. Cabeza laureada a la derecha. Rev.: Roma sedente a la izquierda sobre una coraza, sosteniendo un cetro largo y apoyando el brazo izquierdo en un escudo, S C a través de los campos; ROMA en exergo. Ae. 25,59 g. Bonito y expresivo retrato en alto relieve. Buen ejemplar con una atractiva pátina verde. Ex Bertolami Fine Arts 12 (29/10/2014), lote 676. EBC/EBC-. Est...2500,00.

Description

fine

Grade

1000 EUR

Starting

-

Estimate

1900 EUR

Realized

AI Recommendation

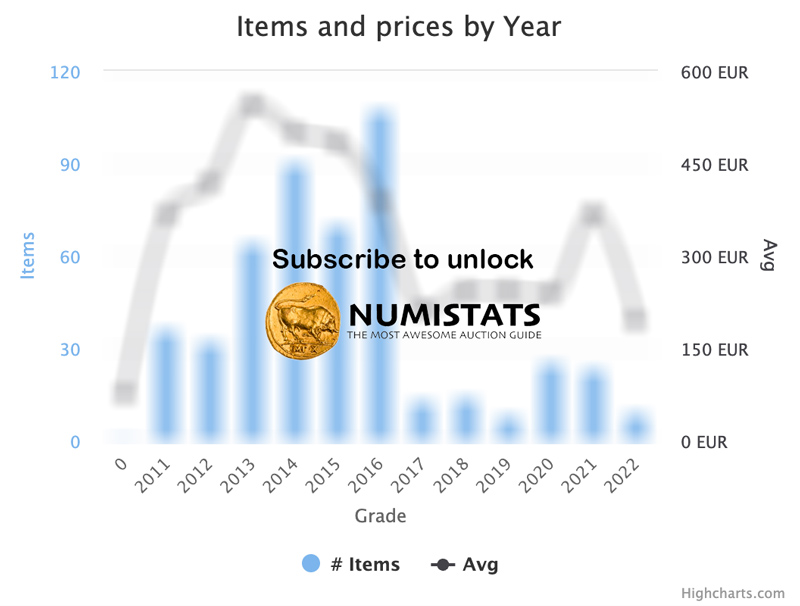

To estimate a maximum purchase price for the coin in question, we will consider several factors:

1. Current Condition: The coin has a condition of 50 (fine), which indicates that it is not in the best condition. This will negatively affect its value compared to coins in better condition.

2. Auction History:

- The coin has been auctioned 6 times, of which it has sold 5 times. This indicates a consistent interest in the coin.

- Previous hammer prices are quite high, especially the one from 2013, where it sold for 22,509.25 euros with a condition of 90. This suggests that, in optimal conditions, the coin can reach very high prices.

- However, hammer prices for lower conditions (such as 75 and 80) are significantly lower, indicating that condition is a crucial factor in pricing.

3. Starting Price and Average Price:

- The current starting price is 1,000 euros, which is relatively low compared to the average hammer price of 6,558.04 euros. This suggests that there is potential for the hammer price to be higher, but it also depends on the condition.

4. Comparison with Previous Prices:

- In previous auctions, starting prices have varied, but the lowest hammer price was 1,200 euros (in 2014), indicating that even in non-optimal conditions, the coin has a minimum value.

Given all this, and considering that the current condition is 50, an estimated maximum purchase price could be set in a more conservative range.

Estimated Maximum Purchase Price: It could be reasonable to estimate a maximum purchase price around 2,500 to 3,000 euros, taking into account the condition and price history. This would allow for a profit margin if the coin is resold in the future, especially if its condition improves or if the market becomes more favorable.

1. Current Condition: The coin has a condition of 50 (fine), which indicates that it is not in the best condition. This will negatively affect its value compared to coins in better condition.

2. Auction History:

- The coin has been auctioned 6 times, of which it has sold 5 times. This indicates a consistent interest in the coin.

- Previous hammer prices are quite high, especially the one from 2013, where it sold for 22,509.25 euros with a condition of 90. This suggests that, in optimal conditions, the coin can reach very high prices.

- However, hammer prices for lower conditions (such as 75 and 80) are significantly lower, indicating that condition is a crucial factor in pricing.

3. Starting Price and Average Price:

- The current starting price is 1,000 euros, which is relatively low compared to the average hammer price of 6,558.04 euros. This suggests that there is potential for the hammer price to be higher, but it also depends on the condition.

4. Comparison with Previous Prices:

- In previous auctions, starting prices have varied, but the lowest hammer price was 1,200 euros (in 2014), indicating that even in non-optimal conditions, the coin has a minimum value.

Given all this, and considering that the current condition is 50, an estimated maximum purchase price could be set in a more conservative range.

Estimated Maximum Purchase Price: It could be reasonable to estimate a maximum purchase price around 2,500 to 3,000 euros, taking into account the condition and price history. This would allow for a profit margin if the coin is resold in the future, especially if its condition improves or if the market becomes more favorable.

Roman Imperial. Nero. Sestertius RIC ric.1(2).ner.356 RIC 356

Nero

Authority

Sestertius

Denomination

-

Mint

-

Year

RIC ric.1(2).ner.356

RIC 356

References

IMP NERO CLAVD CAESAR AVG GERM P M TR P XIII P P

Obverse Legend

ROMA S C

Reverse Legend

Head of Nero, laureate, right

Obverse Type

Roma, helmeted, in military dress, seated left on cuirass, holding spear in right hand, and resting left on shield; various arms around

Reverse Type

Sold (83.33%)

Unsold (16.67%)