Aureo & Calicó, S.L. - Subasta 410 - 2176 Numistats ref: 628874

Ferran II de Nàpols

Authority

Cinquina

Denomination

-

Year

Cru.V.S. 1103

References

Monedas medievales / Medieval coins

Category

Ferran II de Nàpols (1495-1496). Nàpols. Cinquina. (Cru.V.S. 1103) (Cru.C.G. 3520) (MIR 103). Rara. 0,60 g. BC+.

Description

BC+

Grade

60 EUR

Starting

100 EUR

Estimate

135 EUR

Realized

AI Recommendation

To estimate a maximum purchase price for the coin in question, we can consider several factors:

1. Starting price: 60 euros.

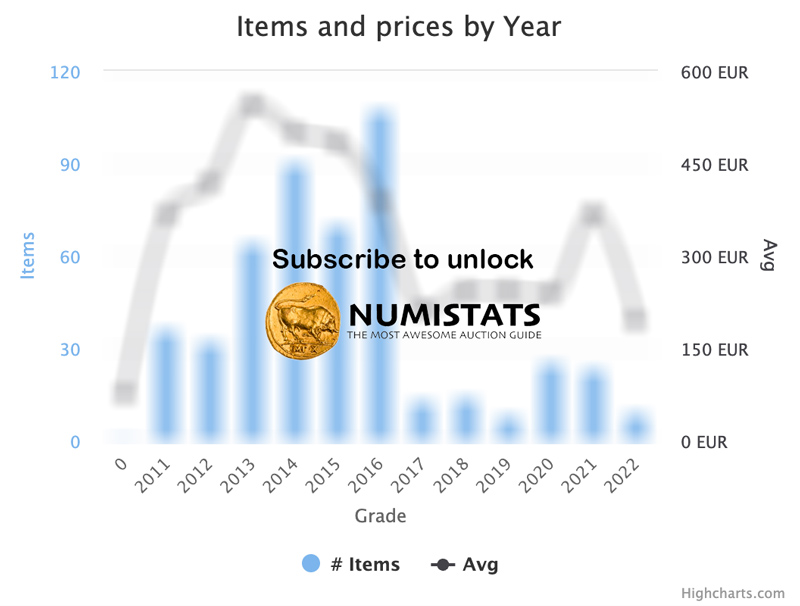

2. Average hammer price in the past: 135 euros. This indicates that, generally, coins of this reference tend to sell for a significantly higher price than their starting price.

3. Condition of the coin: 30 (BC+). This suggests that the coin has a low state of preservation, which could negatively affect its value compared to coins in better condition.

4. Auction history: The coin has been auctioned once and sold on that occasion, indicating that there is interest in it.

Given that the average hammer price is 135 euros, but the condition is low (30), it is reasonable to adjust the estimated price downward.

We could consider a range between the starting price and the average hammer price, taking into account the condition. One approach could be to calculate a percentage of the average hammer price that reflects the condition.

If we consider that the condition of 30 (BC+) could justify a discount of 30-40% off the average hammer price, we could estimate a maximum purchase price of approximately:

- Average hammer price: 135 euros

- 30% discount: 135 - (135 * 0.30) = 94.5 euros

- 40% discount: 135 - (135 * 0.40) = 81 euros

Therefore, an estimated maximum purchase price could be between 81 and 94.5 euros.

In summary, a reasonable maximum purchase price could be around 90 euros.

1. Starting price: 60 euros.

2. Average hammer price in the past: 135 euros. This indicates that, generally, coins of this reference tend to sell for a significantly higher price than their starting price.

3. Condition of the coin: 30 (BC+). This suggests that the coin has a low state of preservation, which could negatively affect its value compared to coins in better condition.

4. Auction history: The coin has been auctioned once and sold on that occasion, indicating that there is interest in it.

Given that the average hammer price is 135 euros, but the condition is low (30), it is reasonable to adjust the estimated price downward.

We could consider a range between the starting price and the average hammer price, taking into account the condition. One approach could be to calculate a percentage of the average hammer price that reflects the condition.

If we consider that the condition of 30 (BC+) could justify a discount of 30-40% off the average hammer price, we could estimate a maximum purchase price of approximately:

- Average hammer price: 135 euros

- 30% discount: 135 - (135 * 0.30) = 94.5 euros

- 40% discount: 135 - (135 * 0.40) = 81 euros

Therefore, an estimated maximum purchase price could be between 81 and 94.5 euros.

In summary, a reasonable maximum purchase price could be around 90 euros.

Alto Medieval. Ferran II de Nàpols. Cinquina Cru.V.S. 1103

Ferran II de Nàpols

Authority

Cinquina

Denomination

-

Mint

-

Year

Cru.V.S. 1103

References

Obverse Legend

Reverse Legend

Obverse Type

Reverse Type

Sold (100%)

Unsold (0%)