Aureo & Calicó, S.L. - Subasta 411 - 1112 Numistats ref: 629929

Pere III

Authority

Croat

Denomination

-

Year

Cru.V.S. 405.6

References

Monedas medievales / Mediaval coins

Category

Pere III (1336-1387). Barcelona. Croat. (Cru.V.S. 405.6) (Cru.C.G. 2223e). Flores de 6 pétalos y cruz en el vestido. A, U y T góticas. Rara. 3,18 g. MBC/MBC+.

Description

MBC+

Grade

200 EUR

Starting

350 EUR

Estimate

280 EUR

Realized

AI Recommendation

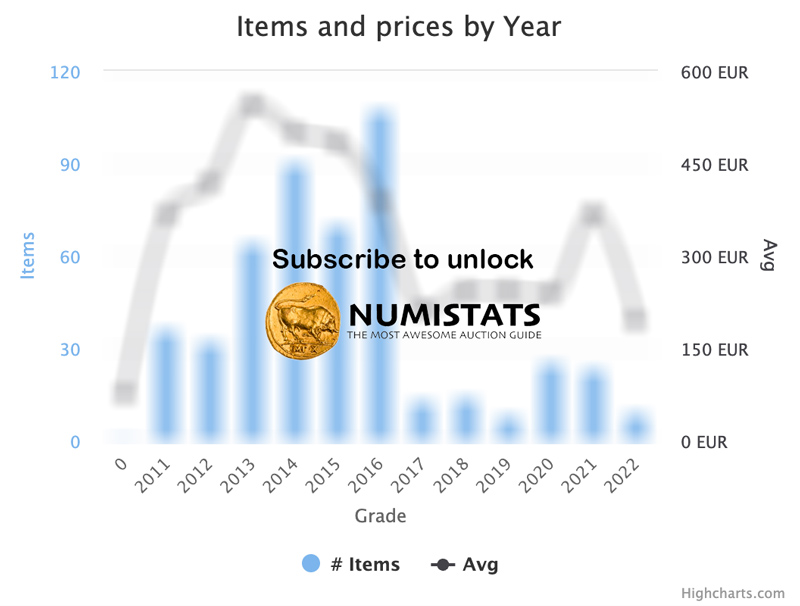

To estimate a maximum purchase price for the coin in question, we can consider several factors based on the provided data:

1. Starting price: 200 euros.

2. Average starting price: 225 euros.

3. Average hammer price: 330 euros.

4. Current condition: 80 (MBC+).

5. Historical data: In the previous auction, a coin in condition 85 sold for 380 euros.

Since the condition of the coin to be auctioned is 80, which is lower than the condition of 85 of the coin that sold for 380 euros, we can infer that the hammer price will be lower.

We can make a proportional adjustment based on the difference in condition. If we consider that the condition of 85 sold for 380 euros, we could estimate that a condition of 80 might have a hammer price in a lower range.

One approach could be to calculate a percentage reduction. For example, if we assume that each point of condition represents a decrease in value, we could estimate that the difference of 5 points (from 85 to 80) could reduce the hammer price by 10-15%.

If we take the average hammer price of 330 euros and apply a reduction of 10-15%, the estimated hammer price could be in the range of:

- 330 euros - 33 euros (10%) = 297 euros

- 330 euros - 49.5 euros (15%) = 280.5 euros

Therefore, an estimated maximum purchase price could be between 280 and 300 euros, considering that the buyer might be willing to pay a little more depending on demand and competition in the auction.

Maximum purchase estimate: 300 euros.

1. Starting price: 200 euros.

2. Average starting price: 225 euros.

3. Average hammer price: 330 euros.

4. Current condition: 80 (MBC+).

5. Historical data: In the previous auction, a coin in condition 85 sold for 380 euros.

Since the condition of the coin to be auctioned is 80, which is lower than the condition of 85 of the coin that sold for 380 euros, we can infer that the hammer price will be lower.

We can make a proportional adjustment based on the difference in condition. If we consider that the condition of 85 sold for 380 euros, we could estimate that a condition of 80 might have a hammer price in a lower range.

One approach could be to calculate a percentage reduction. For example, if we assume that each point of condition represents a decrease in value, we could estimate that the difference of 5 points (from 85 to 80) could reduce the hammer price by 10-15%.

If we take the average hammer price of 330 euros and apply a reduction of 10-15%, the estimated hammer price could be in the range of:

- 330 euros - 33 euros (10%) = 297 euros

- 330 euros - 49.5 euros (15%) = 280.5 euros

Therefore, an estimated maximum purchase price could be between 280 and 300 euros, considering that the buyer might be willing to pay a little more depending on demand and competition in the auction.

Maximum purchase estimate: 300 euros.

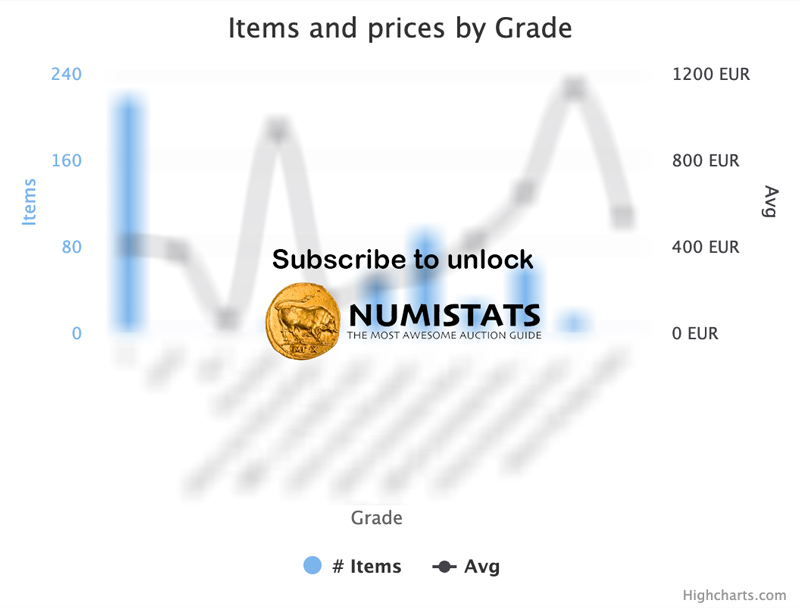

Alto Medieval. Pere III. Croat Cru.V.S. 405.6

Pere III

Authority

Croat

Denomination

Agostar

Mint

-

Year

Cru.V.S. 405.6

References

Obverse Legend

Reverse Legend

Obverse Type

Reverse Type

Sold (100%)

Unsold (0%)