Aureo & Calicó, S.L. - Auction 442 . 1423 Numistats ref: 666452

Isabel II

Authority

2 Escudos

Denomination

-

Year

Aureo-Calicó (2019) 648

Aureo-Calicó (2008) 205

References

Monarquía española. Isabel II (1833-1868)

Category

1868*1868. Isabel II. Madrid. 2 escudos. (AC. 648). Leves golpecitos. Buen ejemplar. Escasa. 25,77 g. EBC-/EBC. Ex Áureo & Calicó 19/10/2016, nº 1804.

Description

ebc-

Grade

250 EUR

Starting

350 EUR

Estimate

270 EUR

Realized

AI Recommendation

To estimate a maximum purchase price for the coin in question, we can consider several factors based on the provided data:

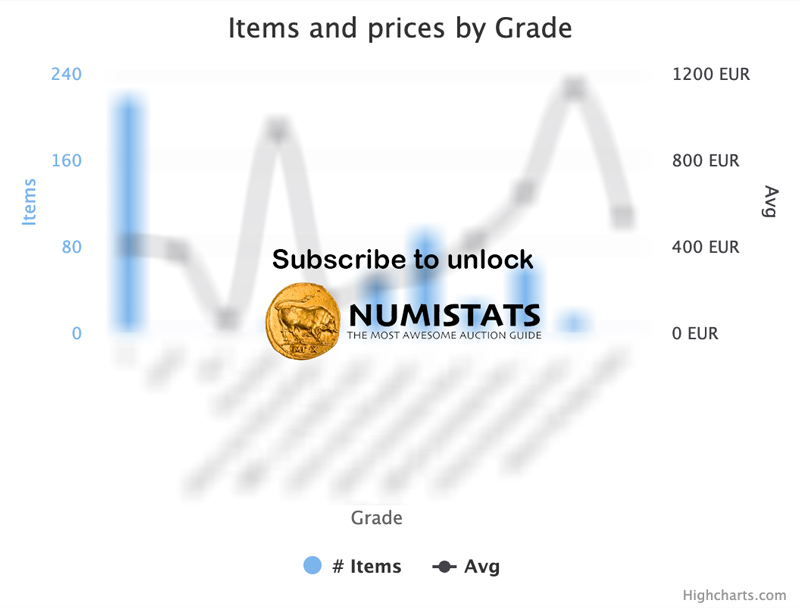

1. Coin Condition: The coin has a condition of 85 (ebc-), indicating that it is in quite good shape. This generally translates to a higher price compared to coins with lower conditions.

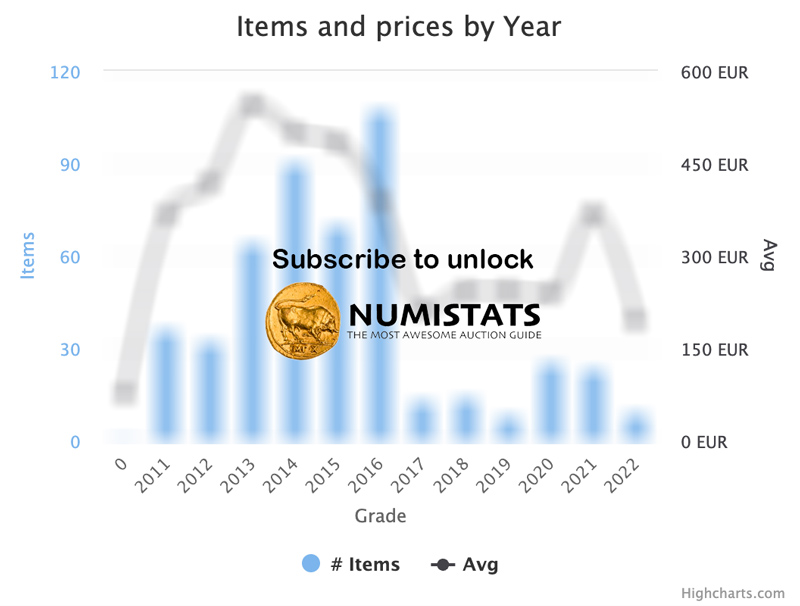

2. Auction History: By observing previous hammer prices for coins with similar conditions (around 80-85), we can see that hammer prices have varied. For example:

- In 2019, a coin with a condition of 85 was auctioned for 195 euros.

- In 2020, a coin with a condition of 80 was auctioned for 160 euros.

- In 2021, a coin with a condition of 85 was auctioned for 250 euros.

3. Starting Price and Average Hammer Price: The current starting price is 250 euros, and the average hammer price for similar coins is 207.5 euros. This suggests that the starting price is reasonable, but it also indicates that there may be room for the hammer price to be higher if there is interest.

4. Auction Trends: The coin has been auctioned 40 times in the past, with an 87.5% sell-through rate (35 out of 40). This indicates consistent interest in the coin, which may influence the hammer price.

5. Recent Hammer Prices: In the most recent auctions, hammer prices have been quite high, suggesting that interest in this coin may be increasing.

Based on these factors, an estimated maximum purchase price could be in the range of 250 to 300 euros, considering that the starting price is 250 euros and there are precedents for higher hammer prices for coins in similar conditions. However, given the interest and condition, a hammer price of up to 300 euros could be reasonable if there is competition in the auction.

1. Coin Condition: The coin has a condition of 85 (ebc-), indicating that it is in quite good shape. This generally translates to a higher price compared to coins with lower conditions.

2. Auction History: By observing previous hammer prices for coins with similar conditions (around 80-85), we can see that hammer prices have varied. For example:

- In 2019, a coin with a condition of 85 was auctioned for 195 euros.

- In 2020, a coin with a condition of 80 was auctioned for 160 euros.

- In 2021, a coin with a condition of 85 was auctioned for 250 euros.

3. Starting Price and Average Hammer Price: The current starting price is 250 euros, and the average hammer price for similar coins is 207.5 euros. This suggests that the starting price is reasonable, but it also indicates that there may be room for the hammer price to be higher if there is interest.

4. Auction Trends: The coin has been auctioned 40 times in the past, with an 87.5% sell-through rate (35 out of 40). This indicates consistent interest in the coin, which may influence the hammer price.

5. Recent Hammer Prices: In the most recent auctions, hammer prices have been quite high, suggesting that interest in this coin may be increasing.

Based on these factors, an estimated maximum purchase price could be in the range of 250 to 300 euros, considering that the starting price is 250 euros and there are precedents for higher hammer prices for coins in similar conditions. However, given the interest and condition, a hammer price of up to 300 euros could be reasonable if there is competition in the auction.

Monarquia Española. Isabel II. 2 Escudos Aureo-Calicó (2019) 648 Aureo-Calicó (2008) 205

Isabel II

Authority

2 Escudos

Denomination

Madrid

Mint

-

Year

Aureo-Calicó (2019) 648

Aureo-Calicó (2008) 205

References

Obverse Legend

Reverse Legend

Obverse Type

Reverse Type

Sold (90.24%)

Unsold (9.76%)