Aureo & Calicó, S.L. - Subasta 411 - 1464 Numistats ref: 630284

Carlos IV

Authority

1/2 Real

Denomination

-

Year

Aureo-Calicó (2019) 346

Aureo-Calicó (2008) 1345

References

Monarquía española / Spanish Monarchy

Category

1799. Carlos IV. Santiago. DA. 1/2 real. (AC. 346). En cápsula de la NGC como VF Details, nº 2887753-002 indica (ensayador CA por error). Limpiada. Colección Val y Mexía. Escasa y más así. Único ejemplar certificado. 1,62 g. MBC/MBC+.

Description

MBC+

Grade

150 EUR

Starting

300 EUR

Estimate

150 EUR

Realized

AI Recommendation

To estimate a maximum purchase price for the coin in question, we can analyze the provided data and consider several factors:

1. Current Condition: The coin has a condition rating of 80 (MBC+), indicating that it is in quite good shape. This generally translates to a higher price compared to coins with lower conditions.

2. Auction History:

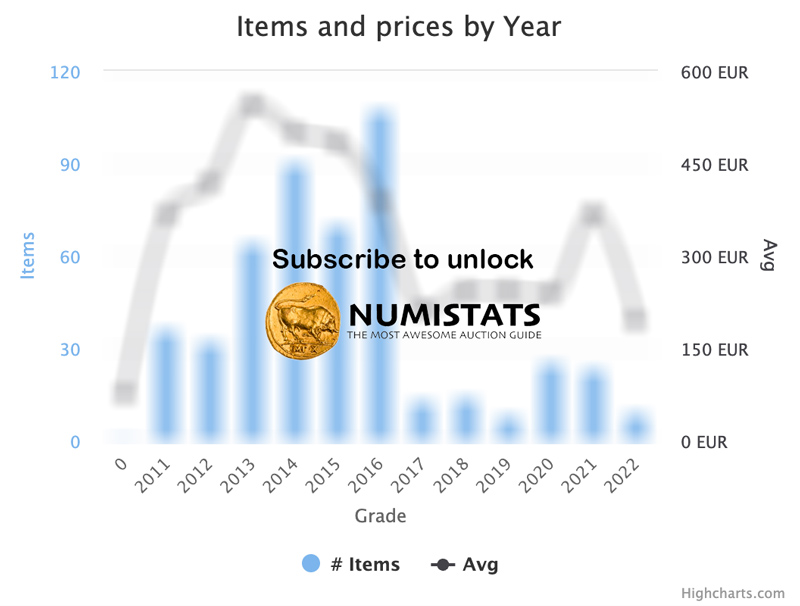

- It has been auctioned 5 times in the past, of which it has sold 4 times. This indicates that there is interest in the coin.

- Previous hammer prices vary, but the highest recorded is 80 euros (in 2021) for a coin with a condition of 30, suggesting that a coin in better condition (80) could fetch a significantly higher price.

3. Starting Price and Average Price:

- The current starting price is 150 euros, which is considerably higher than the average starting price of 75 euros and the average hammer price of 76.25 euros. This could indicate that the seller has high expectations, but it may also be an indicator of demand.

4. Price Estimation:

- Given that the highest hammer price in the past was 80 euros for a coin in worse condition, and considering that the current condition is better, we could estimate that the hammer price could be in a higher range.

- A conservative approach could be to consider a 50-100% increase over the previous highest hammer price, given the condition.

With all this in mind, an estimated maximum purchase price could be between 100 and 120 euros, considering that the starting price is 150 euros, but market interest and the condition of the coin could justify a higher price. However, it is important to keep in mind that the final price will depend on the competition in the auction and the willingness of other buyers.

1. Current Condition: The coin has a condition rating of 80 (MBC+), indicating that it is in quite good shape. This generally translates to a higher price compared to coins with lower conditions.

2. Auction History:

- It has been auctioned 5 times in the past, of which it has sold 4 times. This indicates that there is interest in the coin.

- Previous hammer prices vary, but the highest recorded is 80 euros (in 2021) for a coin with a condition of 30, suggesting that a coin in better condition (80) could fetch a significantly higher price.

3. Starting Price and Average Price:

- The current starting price is 150 euros, which is considerably higher than the average starting price of 75 euros and the average hammer price of 76.25 euros. This could indicate that the seller has high expectations, but it may also be an indicator of demand.

4. Price Estimation:

- Given that the highest hammer price in the past was 80 euros for a coin in worse condition, and considering that the current condition is better, we could estimate that the hammer price could be in a higher range.

- A conservative approach could be to consider a 50-100% increase over the previous highest hammer price, given the condition.

With all this in mind, an estimated maximum purchase price could be between 100 and 120 euros, considering that the starting price is 150 euros, but market interest and the condition of the coin could justify a higher price. However, it is important to keep in mind that the final price will depend on the competition in the auction and the willingness of other buyers.

Monarquia Española. Carlos IV. 1/2 Real Aureo-Calicó (2019) 346 Aureo-Calicó (2008) 1345

Carlos IV

Authority

1/2 Real

Denomination

Santiago

Mint

-

Year

Aureo-Calicó (2019) 346

Aureo-Calicó (2008) 1345

References

Obverse Legend

Reverse Legend

Obverse Type

Reverse Type

Sold (80%)

Unsold (20%)