Aureo & Calicó, S.L. - Subasta 411 - 1461 Numistats ref: 630281

Carlos IV

Authority

1/2 Real

Denomination

-

Year

Aureo-Calicó (2019) 343

Aureo-Calicó (2008) 1342

References

Monarquía española / Spanish Monarchy

Category

1797. Carlos IV. Santiago. DA. 1/2 real. (AC. 343). Atractiva. En cápsula de la NGC como AU50, nº 2887749-015. Ex Áureo & Calicó 28/05/2013, nº 618. Colección Val y Mexía. Rara y más así. Sólo dos ejemplares certificados. 1,66 g. EBC-.

Description

ebc-

Grade

350 EUR

Starting

500 EUR

Estimate

350 EUR

Realized

AI Recommendation

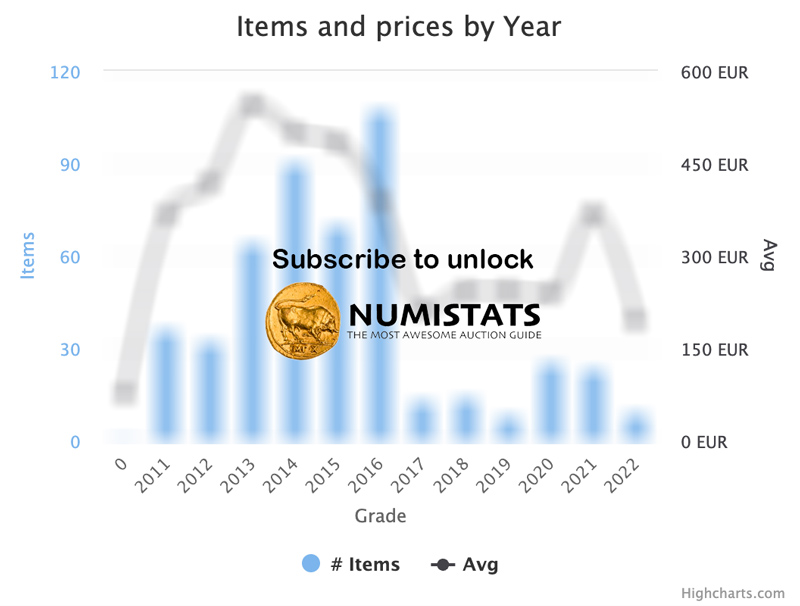

To estimate a maximum purchase price for the coin in question, we can consider several factors:

1. Condition: The coin has a condition rating of 85 (ebc-), which indicates that it is in quite good shape. This generally translates to a higher price compared to coins with lower conditions.

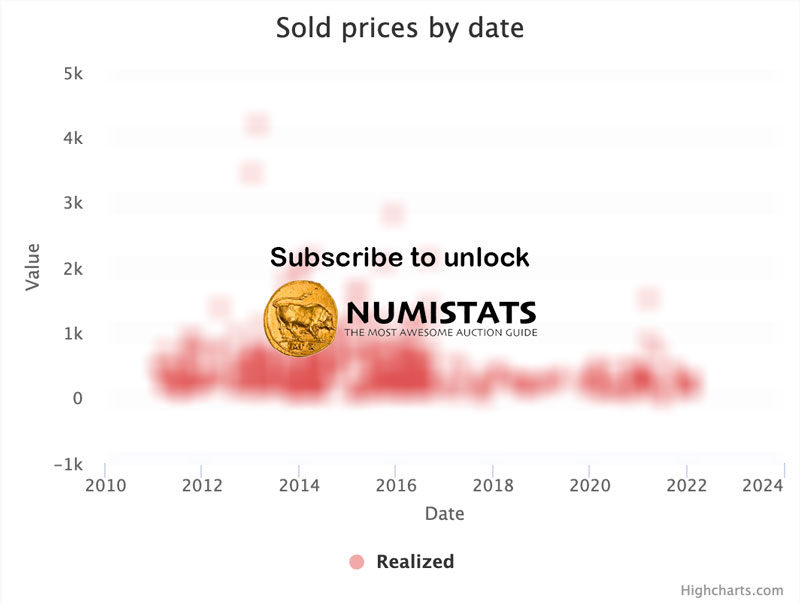

2. Current listing price and previous prices: The current listing price is 350 euros, which is significantly higher than the starting prices of previous auctions. However, the average hammer price in the past has been 106 euros, suggesting that the market has not been willing to pay much more than that in previous auctions.

3. Auction history: The coin has been auctioned 5 times and has sold on all occasions, indicating a consistent interest in the coin. However, previous hammer prices are quite low compared to the current listing price.

4. Market trends: Given that the current listing price is much higher than previous hammer prices, it is possible that the seller is looking to capitalize on an increase in demand or the value of the coin. However, this may also make bidders more cautious.

Taking these factors into account, an estimated maximum purchase price could be in a range between the previous average hammer price (106 euros) and a bit higher due to the good condition of the coin. A reasonable maximum price could be approximately 150-200 euros, assuming that bidders are willing to pay a little more for the condition, but not reaching the listing price of 350 euros, which seems excessive compared to the sales history.

Therefore, an estimated maximum purchase price could be 150 euros.

1. Condition: The coin has a condition rating of 85 (ebc-), which indicates that it is in quite good shape. This generally translates to a higher price compared to coins with lower conditions.

2. Current listing price and previous prices: The current listing price is 350 euros, which is significantly higher than the starting prices of previous auctions. However, the average hammer price in the past has been 106 euros, suggesting that the market has not been willing to pay much more than that in previous auctions.

3. Auction history: The coin has been auctioned 5 times and has sold on all occasions, indicating a consistent interest in the coin. However, previous hammer prices are quite low compared to the current listing price.

4. Market trends: Given that the current listing price is much higher than previous hammer prices, it is possible that the seller is looking to capitalize on an increase in demand or the value of the coin. However, this may also make bidders more cautious.

Taking these factors into account, an estimated maximum purchase price could be in a range between the previous average hammer price (106 euros) and a bit higher due to the good condition of the coin. A reasonable maximum price could be approximately 150-200 euros, assuming that bidders are willing to pay a little more for the condition, but not reaching the listing price of 350 euros, which seems excessive compared to the sales history.

Therefore, an estimated maximum purchase price could be 150 euros.

Monarquia Española. Carlos IV. 1/2 Real Aureo-Calicó (2019) 343 Aureo-Calicó (2008) 1342

Carlos IV

Authority

1/2 Real

Denomination

Santiago

Mint

-

Year

Aureo-Calicó (2019) 343

Aureo-Calicó (2008) 1342

References

Obverse Legend

Reverse Legend

Obverse Type

Reverse Type

Sold (100%)

Unsold (0%)