Aureo & Calicó, S.L. - Subasta 411 - 1451 Numistats ref: 630271

Carlos III

Authority

1/2 Real

Denomination

-

Year

Aureo-Calicó (2019) 303

Aureo-Calicó (2008) 1847

References

Monarquía española / Spanish Monarchy

Category

1788. Carlos III. Santiago. DA. 1/2 real. (AC. 303). En cápsula de la NGC como VF30, nº 2887400-015. Pátina. Ex Áureo & Calicó 16/12/2009, nº 2863. Colección Val y Mexía. Rara. Sólo otros dos ejemplares certificados, éste con la graduación más alta. 1,62 g. MBC-.

Description

MBC-

Grade

250 EUR

Starting

350 EUR

Estimate

508 EUR

Realized

AI Recommendation

To estimate a maximum purchase price for the coin in question, we can analyze the provided data and consider several factors:

1. Coin Condition: The coin has a condition rating of 70 (MBC-), which indicates that it is in relatively good shape, but not of the highest quality (FDC). This can influence the price, as coins in better condition tend to fetch higher prices.

2. Auction History:

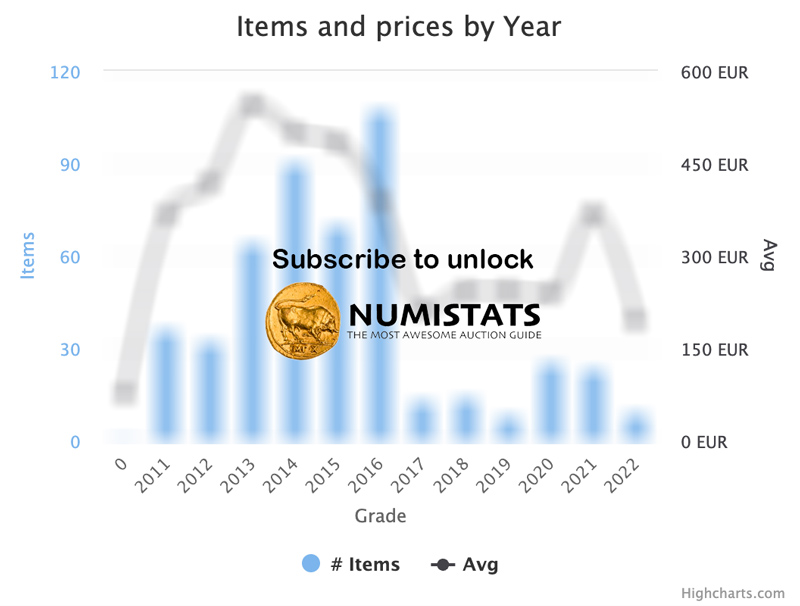

- It has been auctioned 6 times in the past, of which it has sold 4 times. This indicates that there is interest in the coin, but also that there have been occasions when it did not sell.

- The average hammer price in previous auctions is 174 euros, which can serve as a reference for the current price.

3. Previous Prices:

- Previous hammer prices varied, but the highest recorded is 73 euros in 2018, while the lowest starting price was 12 euros in 2020. This suggests that interest and value in the coin have fluctuated.

4. Current Starting Price: The starting price is 250 euros, which is significantly higher than previous hammer prices. This could indicate that the seller has high expectations, but it could also be a risk if interest is not sufficient.

5. Market Trends: Since no more coins are scheduled for auction in the coming days, this could indicate that the market is relatively quiet, which could affect competition and the final price.

Based on these factors, an estimated maximum purchase price could be in the range of 150 to 200 euros. This is based on the average previous hammer price and the condition of the coin, considering that the current starting price is quite high and may not be reached if there is not enough interest.

Therefore, a reasonable maximum purchase price could be 180 euros.

1. Coin Condition: The coin has a condition rating of 70 (MBC-), which indicates that it is in relatively good shape, but not of the highest quality (FDC). This can influence the price, as coins in better condition tend to fetch higher prices.

2. Auction History:

- It has been auctioned 6 times in the past, of which it has sold 4 times. This indicates that there is interest in the coin, but also that there have been occasions when it did not sell.

- The average hammer price in previous auctions is 174 euros, which can serve as a reference for the current price.

3. Previous Prices:

- Previous hammer prices varied, but the highest recorded is 73 euros in 2018, while the lowest starting price was 12 euros in 2020. This suggests that interest and value in the coin have fluctuated.

4. Current Starting Price: The starting price is 250 euros, which is significantly higher than previous hammer prices. This could indicate that the seller has high expectations, but it could also be a risk if interest is not sufficient.

5. Market Trends: Since no more coins are scheduled for auction in the coming days, this could indicate that the market is relatively quiet, which could affect competition and the final price.

Based on these factors, an estimated maximum purchase price could be in the range of 150 to 200 euros. This is based on the average previous hammer price and the condition of the coin, considering that the current starting price is quite high and may not be reached if there is not enough interest.

Therefore, a reasonable maximum purchase price could be 180 euros.

Monarquia Española. Carlos III. 1/2 Real Aureo-Calicó (2019) 303 Aureo-Calicó (2008) 1847

Carlos III

Authority

1/2 Real

Denomination

Santiago

Mint

-

Year

Aureo-Calicó (2019) 303

Aureo-Calicó (2008) 1847

References

Obverse Legend

Reverse Legend

Obverse Type

Reverse Type

Sold (66.67%)

Unsold (33.33%)