Aureo & Calicó, S.L. - Subasta 410 - 2259 Numistats ref: 628957

Felipe IV

Authority

Real

Denomination

-

Year

Aureo-Calicó (2019) 815

Aureo-Calicó (2008) 1101

References

Monarquía española / Spanish Monarchy

Category

1624. Felipe IV. Valencia. 1 divuitè. (AC. 815). 2,06 g. MBC.

Description

MBC

Grade

25 EUR

Starting

40 EUR

Estimate

30 EUR

Realized

AI Recommendation

To estimate a maximum purchase price for the coin in question, we will consider several factors:

1. Current Condition: The coin has a condition of 75 (MBC), which indicates that it is in quite good shape. This generally increases its value compared to coins in lower conditions.

2. Auction History:

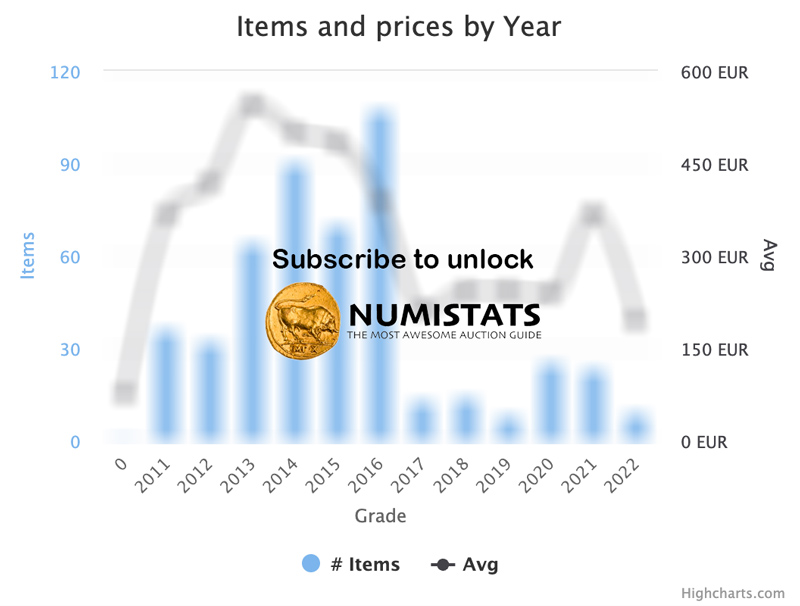

- In the past, the coin has been auctioned 4 times, of which it has sold 2 times. This suggests that there is interest in the coin, although there is also a 50% no-sale rate, which may indicate that the starting price is sometimes too high.

- Previous starting and hammer prices are relevant. For example, in 2019, the starting price was 150 euros and the hammer price was 150 euros with a condition of 80. This suggests that the market is willing to pay close to the starting price under similar conditions.

3. Average Hammer Price: The average hammer price for this coin is 90 euros, which can serve as a benchmark.

4. Average Starting Price: The average starting price is 143.75 euros, indicating that sellers usually expect higher prices.

Given that the condition of the coin is 75, which is lower than the conditions of previous auctions (70 and 80), but still an acceptable state, we can estimate a maximum purchase price.

Considering all these factors, an estimated maximum purchase price could be positioned between the average hammer price and the average starting price, adjusted for condition.

Therefore, a reasonable maximum purchase price could be around 100-120 euros. This reflects interest in the coin, but also takes into account its condition and auction history.

1. Current Condition: The coin has a condition of 75 (MBC), which indicates that it is in quite good shape. This generally increases its value compared to coins in lower conditions.

2. Auction History:

- In the past, the coin has been auctioned 4 times, of which it has sold 2 times. This suggests that there is interest in the coin, although there is also a 50% no-sale rate, which may indicate that the starting price is sometimes too high.

- Previous starting and hammer prices are relevant. For example, in 2019, the starting price was 150 euros and the hammer price was 150 euros with a condition of 80. This suggests that the market is willing to pay close to the starting price under similar conditions.

3. Average Hammer Price: The average hammer price for this coin is 90 euros, which can serve as a benchmark.

4. Average Starting Price: The average starting price is 143.75 euros, indicating that sellers usually expect higher prices.

Given that the condition of the coin is 75, which is lower than the conditions of previous auctions (70 and 80), but still an acceptable state, we can estimate a maximum purchase price.

Considering all these factors, an estimated maximum purchase price could be positioned between the average hammer price and the average starting price, adjusted for condition.

Therefore, a reasonable maximum purchase price could be around 100-120 euros. This reflects interest in the coin, but also takes into account its condition and auction history.

Monarquia Española. Felipe IV. Real Aureo-Calicó (2019) 815 Aureo-Calicó (2008) 1101

Felipe IV

Authority

Real

Denomination

Valencia

Mint

-

Year

Aureo-Calicó (2019) 815

Aureo-Calicó (2008) 1101

References

Obverse Legend

Reverse Legend

Obverse Type

Reverse Type

Sold (50%)

Unsold (50%)